Jersey’s funds industry will be ‘all about change’ in 2026, according to members of the Jersey Funds Association (JFA) committee speaking at the annual Chairman’s Update event earlier this month 15 January).

At the event, Chairman Joel Hernandez – also a partner at law firm Mourant – reflected on what had been a positive 2025 for Jersey’s funds sector, with Assets Under Administration (AUA) growing by 5% over the year and more than 100 Jersey Private Funds (JPFs) being established.

He also pointed to the positive longer-term picture, with AUA in Jersey doubling over the past ten years and more than 1,600 private funds being authorised since the JPF regime was introduced in 2017.

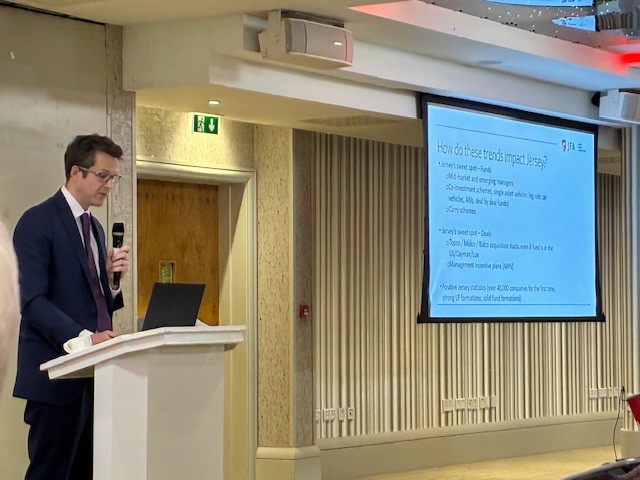

However, Joel also pointed to the increasingly competitive market and the need for Jersey to adapt, while JFA Vice-Chair Dilmun Leach – also a partner at Walkers – provided insights into the key trends shaping the current cross-border funds landscape, including a global overall slowdown in fundraising and concentration of fundraising amongst larger managers.

The theme of change was echoed by Chris Griffin, Chair of the Legal and Technical sub-committee and partner at Carey Olsen, who outlined a number of initiatives the JFA was involved in aimed at enhancing Jersey’s funds ecosystem, while Jeffrey Parongan – a Director at KPMG Crown Dependencies - provided an insight into the JFA’s Education and Training programme for the year ahead.

Commenting on the focus on evolution and innovation in Jersey’s funds ecosystem, Joel said:

“We are operating in a competitive and complex marketplace and as a jurisdiction we need to shift our focus to selling solutions to the challenges faced by investors and managers, by focusing on what matters to them. Speed to market, being cost-effective, regulatory choice and simplicity – these are all of critical importance and our focus at the JFA is to ensure that, by working closely with the Government of Jersey, the JFSC and Jersey Finance, we are making significant changes to deliver in those areas.”

Reflecting on market trends, Dilmun said: “It’s important to understand where global capital is coming from and there’s no doubt, the picture is becoming more complex. The industry is now less about blind pooled funds, and more about tailored investment, corporate structuring, private capital, tokenisation and digital assets. This should actually suit Jersey very well, given our range of fund and corporate regimes we can offer, in particular in the secondaries, emerging and first -time manager markets. There are more companies on our register than ever before, for example. But we need to continue to shift the dial in these areas.”

Joel added: “The reality is that funds are raising less. Our challenge is to engineer a position where Jersey can support funds that are active – and there are already a whole raft of initiatives under way to support that. The changes to the JPF regime in 2025, for instance, were part of this evolution and have already resulted in a spike in interest in our private funds capabilities.

“Elsewhere, we are also looking at changes relating to AIFMD II, innovation through the concept of Jersey Cellular Partnerships, streamlining our regulatory framework to make it simpler, and serving the needs of the full spectrum of investors, including the sophisticated retail segment. As a result, we should be in no doubt – 2026 will be a year of significant change for Jersey’s funds industry.”

Members of the JFA committee provided an analysis of the market at the recent Chairman’s Update event...

Enhancements to the Jersey Private Fund (JPF) regime will come into effect on 6 August 2025...

The Government of Jersey and the Jersey Financial Services Commission (JFSC) have announced further enhancements to the Jersey Private Fund (JPF) regime.

The latest enhancements are the product of significant collaboration between the Government of Jersey, the JFSC, Jersey Finance and the Jersey Funds Association (JFA) and come into effect on 6 August 2025.

Combined, the changes seek to address evolving trends in the private capital space, including scalability, flexibility and speed to market. The enhancements include:

- Removal of the 50 offer/investor cap: a JPF may now make an unlimited number of offers and have an unlimited number of investors, provided the offer is made to a "restricted group of investors" and that each investor is a "professional investor" as defined in the Jersey Private Fund Guide (JPF Guide) published by the JFSC. A new Ministerial Order has been passed (known as the Collective Investment Funds (Jersey Private Funds) Order 2025 (the JPF Order), which introduces a simplified test for a 'restricted group of investors' which means: (i) the offer is addressed to an identifiable category of persons to whom it is directly communicated by the offeror or the offeror's appointed agent; and (ii)only persons in that category may accept the offer.

- 24-hour authorisation: the JFSC has introduced a streamlined 24-hour authorisation timeframe for JPF regulatory consents.

- Listing may be permitted: units/shares/interests in a JPF may now be listed with the consent of the JFSC.

- Widened definition of professional investor: the JPF Guide already includes 12 broad categories of investors that can invest in a JPF, the updated JPF Guide has now been expanded further.

The updated version of the JPF Guide, together with a Q&A for industry, will be available on the JFSC's website.

Joel Hernandez, Chair of the JFA said:

"The JFA welcomes the Government and the JFSC's continued commitment to further refine and strengthen the Jersey Private Fund regime. The JPF regime remains a strong solution for the global market, offering efficient, streamlined, and proportionate regulation for private investment funds. Its improved flexibility, accessibility and simplicity to launch continue to enhance the JPF regime's effectiveness."

The JFA has confirmed its new committee, following its recent AGM...

The Jersey Funds Association (JFA) has confirmed its new committee, following the organisation's Annual General Meeting last week (11th July).

Joel Hernandez (Head of Investment Funds at Mourant) has been appointed as Chair of the JFA, taking over the reins from Michael Johnson, who has come to the end of his three-year term. Dilmun Leach (Partner at Walkers (CI) LP) has been appointed Vice Chair.

The JFA's main committee also includes Robin Wilson (Treasurer), Michael Johnson, Richard Anthony, Mike Byrne, John Riva, Steve Cartwright, Ben Dixon, Stephanie Webb, Robert Milner, Tim Morgan, Simon Page, Tom Powell, Sophie Reguengo, Martin Rowley, Martin Paul, Jon Stevens, Elliot Refson, Chris Patton, Gary Ayres, Alison Gurd, John Everett and Jeffrey Parongan.

Commenting after the AGM, Joel said:

“Reflecting on the past year at our AGM and following the JFA's annual dinner last month, it’s clear there is real positivity across Jersey’s funds industry. Despite geopolitical uncertainty, global fundraising headwinds and liquidity constraints, Jersey’s funds industry remains resilient and continues to grow – however the JFA is cognisant that an increased focus on product innovation and progress is critical if Jersey is to retain its position as a leading funds jurisdiction.”

Speaking on his appointment as Vice Chair, Dilmun added:

“I’m delighted to be taking on the role of Vice Chair of the JFA at what is an important time for our industry. A number of exciting enhancements are in train in terms of product innovation, technology and regulatory changes, and the JFA is committed to driving progress in all these areas. Together with Joel and the wider committee, I’m looking forward to continuing to serve the needs of the industry and ensure Jersey continues its upwards trajectory.”

Figures show that a growing number of global fund managers are finding appeal in Jersey’s regulatory platform for accessing EU capital...

A growing number of global fund managers are finding appeal in Jersey’s regulatory platform for accessing EU capital, according to year-end figures.

According to data collated by the Jersey Financial Services Commission (JFSC), 240 alternative investment fund managers (AIFMs) were using Jersey’s national private placement regime (NPPR) to market their funds to the EU investor market at the end of 2024 – a year-on-year increase of 4%.

Those managers were marketing 448 separate funds to EU investors through Jersey’s NPPR route to market – an annual uptick of 8%, spanning the full spectrum of alternative asset classes, including private equity, venture capital, real estate and infrastructure.

The longer-term figures support that upward trend – over five years, the number of managers using Jersey’s private placement regulatory regime has grown by 31%, with the number of funds being marketed into the EU this way growing by 40% (compared to December 2019).

Commenting on the figures, Elliot Refson, Head of Funds, Jersey Finance, said:

“These latest figures reinforce the trend we have been seeing for some years as managers outside of the EU bloc have sought to market their funds effectively to EU investors against the backdrop of the AIFMD and wider complex international regulatory landscape. Jersey’s private placement regime offers those managers a tried-and-tested solution with tax neutrality, regulatory simplicity and cost-effectiveness, all contributing to its appeal.

“Whilst growth has previously been driven by Brexit for UK managers, more recently we have seen interest from managers in other locations outside of the EU – in particular Asia and the US – as managers have responded pragmatically to market conditions to optimise their structuring and operating frameworks where there is an EU nexus. Jersey has been a beneficiary of that.”

Michael Johnson, Chair, Jersey Funds Association, added:

“Alternative fund managers appreciate the experience and expertise Jersey’s ecosystem offers when it comes to global alternative fund distribution – and in the context of European fundraising, its private placement option is a highly efficient and cost-effective means of accessing that EU capital. With EU figures indicating that only around 3% of managers actually need blanket EU coverage and a full onshore presence – and with Jersey’s positive Moneyval assessment last year providing further reassurance – we fully expect Jersey’s private placement option to retain its appeal in the years ahead.”

The figures follow the recent publication of the latest annual Monterey Jersey Fund Report 2024, which shows that the value of Assets Under Administration (AUA) in Jersey’s funds industry grew by 6.1% year on year (as at June 2024) to stand at an all-time high of US$630bn, whilst the number of fund vehicles established in Jersey also rose, with the total number of funds and sub-funds serviced in Jersey up to 2,450 – the most ever recorded in Monterey’s Jersey reports.

The JFA’s Legal and Technical and Risk and Compliance Sub-Committees recently provided an update on the current landscape and some of the measures the industry is taking to maintain Jersey’s leading position as a centre for alternative investment funds...

Members of the JFA’s Legal and Technical and Risk and Compliance Sub-Committees provided an update to professionals from across Jersey’s funds sector recently, at a briefing that explored the current landscape and some of the measures the industry is taking to maintain Jersey’s leading position as a centre for alternative investment funds.

Setting the scene, Joel Hernandez, Vice Chair of the JFA and Chair of the JFA Legal and Technical Sub-Committee, highlighted the pressure the funds industry has seen over the past year.

He also pointed out that competition between international finance centres remains intense and that Jersey's continued attractiveness as a fund domicile relies on it continuing to have jurisdictional stability, effective regulatory options and tax simplicity. Considerations such as service quality, talent retention, being digitally enabled and cost-effectiveness are key to differentiating Jersey from other IFCs in the coming years.

Joel also highlighted the progress the JFA has made in supporting changes across Jersey’s funds sector. Notably this has included the JFA's work with the Jersey Financial Services Commission (JFSC) and Jersey Finance on the recent updates to the Jersey Private Fund (JPF) Guide, as well as the recent JFSC guidance issued on the Tokenisation of Real-World-Assets.

Commenting on the event, Joel Hernandez, Vice Chair of JFA and Chair of the JFA Legal and Technical Sub-Committee, said:

“There’s no doubt the past year has been challenging for the funds industry at large. Part of the JFA's role has been to help industry respond to these challenges by progressing developments through collective innovation with the JFSC and Jersey Finance."

“Despite the challenges, there is good reason for Jersey's funds industry to remain positive given its strong position. It's also pleasing to also see industry, government and the regulator collectively moving towards a "growth mindset" and a renewed focus on innovation. This will be critical to the future success of the Jersey funds industry."

Jon Stevens, Chair of the JFA Regulatory and Compliance Sub-Committee, added:

“Against that backdrop, asserting Jersey’s relevance as a robust, expert and progressive centre is critical. Offering regulatory choice, delivering on speed to market and tax simplicity with a familiar rule of law and good access to EU investor capital will all be important as we move into 2025 – all whilst maintaining a close eye on cost effectiveness.”

Believe it or not, the Jersey Expert Fund regime is 20 years old this year! Here, JFA members reflect on the significance of the regime and how it has helped evolve Jersey's alternative funds proposition...

This year, the Jersey Expert Fund regime marks 20 years since its inception. Here, members of the Jersey Funds Association give their thoughts on how the regime has galvanised Jersey’s proposition in the alternative investment space, and why the structure remains such a popular solution amongst fund managers today …

Q: The Jersey Expert Fund Regime came into being in 2004 - what was the thinking back then in introducing such a product?

Joel Hernandez, Vice-Chairman of the Jersey Funds Association and Chair of the JFA Legal & Technical Sub-Committee (JH): The Jersey Expert Fund regime can best be described as an innovative leap forward for the Island’s funds industry back in 2004. It was introduced to allow more flexibility for fund and asset managers as well as to provide a genuine speed-to-market advantage.

It did this by relaxing a number of policies and rules on the structure and operation of the fund with the aim of creating an attractive and popular route for abroad range of asset classes, including private equity, property and hedge funds as well as other funds investing in alternative asset classes.

Q: What did the Expert Fund Regime add to Jersey’s funds landscape, and what impact did it have on managers and investors?

Daniel Birtwistle, Managing Partner - Jersey, Mourant (DB): Having acted on the very first Jersey Expert Fund back in 2004, it was clear that a key element of the new regime was its ability to authorise a regulated investment fund within 72 hours.

Michael Johnson, Chair of the Jersey Funds Association (MJ): Previously, that authorisation process might have taken weeks. It was a fundamental change and truly a game changer for Jersey. As a testament to the regime, hundreds of Jersey Expert Funds have been launched over the past 20 years, and this includes some of the world's largest investment funds.

DB: It’s certainly the case that, twenty years later, there are still very few jurisdictions that can match the speed and flexibility of Jersey's Expert Fund regime.

Q: How significant was the introduction of such a regime for Jersey?

JH: It was an immediate success. A significant number of real estate funds we relaunched after its introduction and many of those funds continue to this day. More recently, Jersey Expert Funds have been used for sizeable private equity fund launches, with subscriptions reaching into the billions.

The regime helped solidify Jersey's reputation as a market-leading funds domicile, particularly in the alternatives space. When combined with the flexibility of fund vehicle choice – whether it be a Jersey unit trust, corporate entity or partnership - and experienced Jersey fund administrators, it’s a regime that continues to provide fund managers with all the key ingredients for the success of their investment fund. In a sense, it was a regime that was ahead of its time.

Q: How has use of the regime evolved over the last two decades?

JH: The regime has withstood the test of time with very little change needed to refine it over the last 20 years and it continues to be a product-of-choice for some of the world's largest fund managers.

The regime did however need to evolve following the introduction of the Alternative Investment Fund Managers Directive (AIFMD). As another clever solution, Jersey's regulatory framework was adjusted to provide for an additional regulatory "overlay" to allow Jersey Expert Funds to be marketed to EEA investors under the various European national private placement regimes under AIFMD. These amendments ensured that Jersey continued to have a place with European investors who could still benefit from investing in Jersey Expert Funds.

Q: So how does the regime sit now within Jersey’s full armoury of fund regimes?

MJ: The Jersey Expert Fund regime continues to be one of the Island’s cornerstone products for fund and asset managers. It is an example of Jersey’s forward-thinking and innovative approach, and ability to being products to market to meet demand.

Overall, the regime tends to suit larger investment funds with 50 or more investors orthose fund managers looking for a fund product with non-intrusive fund regulation. It also perfectly complements Jersey's other success story, the Jersey Private Fund regime, which provides for 50 or fewer investors, with both products forming key elements of Jersey's compelling offering.

Although 20 years old this year, there’s plenty of life left in the regime yet.

More than 400 professionals from across Jersey's funds industry attended this year’s JFA Annual Dinner, held at the Trinity Showground recently...

Professionals from across Jersey’s growing funds industry came together last month to explore the key trends shaping the cross-border funds landscape and celebrate Jersey’s achievements over the past year.

More than 400 people from across the industry, including lawyers, fund administrators, fund managers, compliance experts and accountants as well as politicians and regulatory representatives, attended this year’s Jersey Funds Association (JFA) Annual Dinner, held at the Trinity Showground on 28th June.

Speaking at the event, Michael Johnson, JFA Chair, told the audience that, in a challenging year globally for the sector, Jersey had held its position well. In particular, he pointed to the ongoing success of the Jersey Private Fund (JPF) regime, with the total number of JPFs now standing at just over 700 – an increase of 100 since last year – whilst the total assets under administration in Jersey now sits at £520bn.

Nevertheless, he pointed to the need to maintain momentum if Jersey was to retain its leading position as a European funds domicile with global ambitions. He said:

“After five continuous years of growth, the performance over the past year was largely flat, which is a first for Jersey, but not unexpected given the incredibly difficult fundraising environment we have seen over the past year at a global level. The outlook remains calm but not stable, and we need to be alive to the macro conditions shaping our industry.”

In particular, Michael highlighted that alternatives – including private equity, real estate and venture capital - continue to represent 90% of Jersey’s total funds business, a model that has created a stable platform of long-term capital. However, there was now a risk of that model being buffeted by global trade-winds, with Michael urging caution in the face of increased competition as market conditions improve:

“There are brighter times on the horizon but we cannot be complacent. Investors are continuing to apply pressure and are focusing new commitments on a narrow swathe of funds. Equally the activity related to the mountain of dry powder available remains stunted by historical standards. It’s vital that Jersey recognises that these macro-economic and political circumstances are out of our control and finds ways to ensure it can keep its wheels turning.

“It’s critical that we focus acutely as a jurisdiction on what managers really care about when it comes to choosing a fund domicile and assert our core strengths – our speed and our high-quality service levels in particular. By embracing innovation and being agile, we can also enhance our product and service range, including exploring the introduction of a Jersey ELTIF solution and clarifying our virtual assets proposition, for instance.”

Vice Chair of the JFA Joel Hernandez pointed further to the need for targeted innovation, and the significant volume of technical issues the JFA had addressed over the past year. In particular, he highlighted updated guidance to the JPF and progress being made in the virtual assets space:

“The recently published updated JPF Guide will help evolve and modernise that product further. This includes widening the categories for eligible investors, mutual recognition for carry schemes that have an element of team co-investment and widening the categories for family and employment connections. A similar approach is also being taken to update the JFSC's guidance to industry on virtual assets, specifically the tokenisation of real-world assets. This is a clear trend and it’s vital that Jersey maintains its reputation for good practical guidance to secure its future in this space.”

Gold sponsor for the evening was Mourant and silver sponsors were IQEQ, PwC, Ogier and BNP Paribas whilst the champagne reception was sponsored by Carey Olsen and the NextGen table was hosted by Gen II and KPMG.

JFA welcomes newly published updated Guide for Jersey Private Funds

The Jersey Financial Services Commission (the JFSC) has announced a number of updates to its Jersey Private Fund Guide (the JPF Guide).

A copy of the updated JPF Guide together with a consolidated redline is available on the JFSC website: https://www.jerseyfsc.org/jersey-private-fund-guide/.

The updates are the product of significant collaboration between the JFSC and the Jersey Funds Association (JFA), the Jersey Association of Trust Companies, Government and Jersey Finance Limited. The JFA was represented by Joel Hernandez, Vice Chair and Chair of the JFA's Legal & Technical Sub-Committee and Jon Stevens, Chair of the JFA's Regulatory & Compliance Sub-Committee.

Updates to the Jersey Private Fund Guide

The Jersey Private Fund regime provides fund promoters with a cost effective, fast-track (48 hour) regulatory approval process for their Jersey private fund (a JPF) which can be offered to up to 50 investors that meet certain eligibility requirements.

The updates are designed to further improve the JPF Guide and the JPF regime. They include:

1. Carry and/or co-investment vehicles

A recognition that co-investment can, in some cases, form part of a fund's carry/incentive arrangement. Previously, carried interest vehicles were not counted as an investor, however the amendments extend this principle to co-investment arrangements that meet the requirements in the JPF Guide.

2. Investor eligibility

General: clarification that investor eligibility is satisfied upon admission. That eligibility can continue to be relied upon despite a status change, for example a departing 'employee, director, partner or expert consultant’.

Transfers (for example death or bankruptcy):for any involuntary transfer, such as on death or bankruptcy, there is no requirement for the transferee to qualify through the same criteria as the transferor, but the transferee will (itself) need to meet the investor eligibility requirements as defined in the JPF Guide.

Service providers: an expansion of the categories of ‘professional investor’ for the benefit of the JPF's service providers, by:

3. Governing Body

The JFSC has clarified its expectation that there should be at least one or more Jersey resident directors appointed to a JPF board or to its governing body. The JPF annual compliance return will request additional data by asking how many Jersey resident or non-Jersey resident directors are on the board of the JPF or its governing body and how many of those directors are employees of the Jersey based designated service provider (DSP) or a group entity of the DSP.

4. Arrangements that fall outside of JPF

Changes have been made to the section that deals with arrangements that are not to be treated as JPFs. These include certain family (including family office) arrangements as well as some incentive arrangements (for example carry and/or co-investment vehicles).

The definitions of employees and family connections (including the term 'relative') have been widened and now include trusts established for a person satisfying the wider definition of 'family connection' (not just for a specific person or their dependents).

The JFSC has also clarified its expectation that JPFs should be:

Where a JPF is established in a country or territory outside of Jersey, having its governing body and management and control outside of Jersey, post authorisation the JFSC will request additional data on the JPF from the DSP, to establish the JPF’s indirect but relevant nexus to Jersey.

5. Additional key changes

Certain consequential changes/references to the Money Laundering (Jersey) Order2008 and the JFSC's Outsourcing Policy have been added to the JPF Guide.

Vice-Chair of the JFA, and Chair of the JFA's Legal & Technical Sub-Committee, Joel Hernandez, said:

'We're pleased to see the JFSC's commitment to work with the funds industry to refine the JPF regime. The JPF regime continues to provide an excellent solution for the global market through its effective, streamlined and proportionate regulation for a private investment fund. The speed and ease with which a JPF can be launched underlines the effectiveness of the regime.'

Chair of the JFA, Michael Johnson, added:

'The Jersey Private Funds regime has been an enormous success for our funds industry. Since its introduction in 2017, over 700 private funds have been launched, further reinforcing Jersey's reputation as a funds domicile. The latest updates mark another positive step forward for our industry.'

Funds Europe recently held a roundtable looking at Jersey's growing expertise and experience in tokenisation and digital assets...

Funds Europe recently held a roundtable looking at Jersey's growing expertise and experience in tokenisation and digital assets.

Specialists from across Jersey's funds sector explored the shift towards a rising importance of digitalisation within the private markets, and how Jersey is innovating to meet that demand

Read the full roundtable here.

JFA members reflect on why recent SEC rule changes provide an opportunity for US managers to look at Jersey for their structuring solutions...

Members of the Jersey Funds Association reflect on the changing US regulatory landscape for private funds, what it means for fund managers, and how the changes are providing an opportunity for managers to re-think their structuring solutions to suit investor demands…

Regulatory shifts in the US private funds market have certainly created a huge amount of discussion in recent months, with managers continuing to get to grips with what the changes mean.

The US Securities and Exchange Commission (SEC) announced last year a set of amendments to the 1940 Investment Advisers Act – a lengthy set of proposals relevant to private fund advisors, the implications of which have taken sometime to filter through to the US manager community.

Aimed at creating a fairer environment with improved fee transparency, the rules – which follow those already in place for hedge funds - introduce enhanced regulation for private fund advisors and added rules around portfolio transparency and ‘democratising’ fee structures, representing a significant shift in private market industry practice.

Amongst the various provisions in those amendments, for example, is a requirement for quarterly reporting, something that may not be as straightforward as some managers had initially thought.

The changes have heralded calls from managers for further guidance on issues where further clarification is needed, and where some of the rules have the potential to create additional complexity for private fund advisors and added compliance costs. From an investor perspective, there is also the potential for preferential rates being offered to their peers, presenting further associated issues.

The result is a divided US private fund landscape, with as many groups, trade bodies and associations supporting the new rules as there are opposed to them – and there is a chance that the changes might be the end of it, if calls to reconsider are met with open ears.

Domiciles in Focus

In the wake of the rule changes, US managers have undoubtedly increased their enquiries relating to their domicile choices, taking the view that they can mitigate their administrative burden by revisiting their administration, structuring and governance frameworks.

“This is a period of concern for US managers and domiciles have come into focus as part of manager considerations,” says JFA committee member and Mourant Partner Alistair Horn.

“When it comes to transparency requirements, particularly around fees, they want certainty, security and guarantees from their domiciles that their structures can stand up to international regulatory scrutiny – and in some cases, stress tests with the more traditional existing jurisdictional partners in the Caribbean have not filled them with confidence.”

Jersey’s Solution

From Jersey’s point of view, this has provided an opportunity to remind US managers that it can provide advantages over other jurisdictions for private fund structures, including those in the Caribbean, in particular when it comes to high standards of governance and an ability to demonstrate genuine substance.

Key advantages include:

· Lower cost of formation and maintenance, with no requirement for a Jersey Private Fund (JPF) to appoint an auditor. This makes the JPF regime cost-effective and quick to set up compared to Private Fund regimes in other jurisdictions.

· Tax neutrality and great credentials on compliance with international standards

· An internationally respected regulatory environment for funds, with robust and clear requirements around appointing directors and service providers

· Investor familiarity, especially when marketing into the EU

Further detail around the Jersey Private Fund regime compared to other domiciles can be found here.

To bring this further to life, in 2023, the net asset value of regulated funds under administration in Jersey grew to almost US$600bn, while the Jersey Private Fund continued cemented its position as a go-to vehicle for professional investors, with 645 registered in total.

The jurisdiction also continued to see an ever-increasing community of managers fully resident in the island across private equity, hedge fund, venture capital, debt and real estate with these managers bringing a real depth and diversity to the industry at a time when substance remains high on the agenda.

Jersey’s platform as a gateway to EU investor capital through private placement has also remained strong. Today more than 200 non-EU managers –including those in the US and UK - are using the private placement route through Jersey to access Europe. It’s a figure that has grown by around 60% in five years, without the hassle and expense of full onshore AIFMD compliance.

“The SEC rule changes have acted as a prompt for US managers to take stock, re-evaluate and look elsewhere for opportunities, and, as all the indicators, data and figures reflect, Jersey is absolutely able to meet that call. In fact, it is already doing so,” explains Michael Johnson, JFA Chair and Group Head of Institutional Services at Crestbridge.

In particular the issue of governance remains pivotal, says Dilmun Leach, JFA Committee member and Partner at Walkers:

“At the heart of all this is depth of expertise, substance and governance, and this is where Jersey really excels. Ultimately what managers want is peace of mind, and Jersey delivers on that. The JPF is incredibly quick and cost-effective to set up, the regulatory environment is clear and unambiguous, and the expertise available, including a number of one-stop shops who can hand-hold managers through the process, is truly market leading. For many US managers, it’s proving a breath of fresh air.”

What Next

The US regulatory landscape will no doubt continue to evolve this year –but regardless of whether these latest SEC rule changes are maintained in full, in portion or not at all, the change has already prompted managers to revisit their structures, question the status quo and begin to ask questions as to whether their existing positions are the best possible solutions for investors.

Given its well-established governance and substance credentials, its global distribution capabilities and its finely honed regulatory ecosystem, Jersey is well placed to support those US managers looking for an alternative and viable solution that can support them with both their global compliance obligations and their investor aims in the long run.

The JFA committee highlighted the strong performance of Jersey's funds sector in 2023, and outlined its priorities for the year ahead at its annual update held recently...

Jersey’s funds industry has continued to perform well against a challenging macro environment but needs to remain agile and place a genuine emphasis on innovation in key areas to meet the competitiveness of an evolving industry, according to speakers at a recent Jersey Funds Association (JFA) Chairman’s Update event.

Held at the Pomme d’Or earlier last month (16 January), the event saw Chairman Michael Johnson discuss the current landscape and set out the organisation’s priorities for 2024, while Vice Chairman Joel Hernandez provided a legal and technical update.

Highlighting the robustness of the Island’s funds sector, Michael pointed to the £525bn net asset value of the sector and the continued success of the Jersey Private Fund (JPF), with 664 JPFs formed since the product was launched, making it the go-to product for sophisticated investors.

He also highlighted that the alternative asset classes now make up 81% of Jersey’s total funds business with private equity and venture capital accounting for the lion’s share.

Meanwhile, private placement continued to prove a popular access route to EU capital through Jersey, with 391 funds now being marketed by 213 fund managers, while the industry is also supporting an increasingly broad geography of managers, from Asia and Africa to the US, highlighting the jurisdiction’s global capabilities.

Commenting, Michael said: “The continued strength of our funds sector is testament to our offering, particularly our stable and no-change proposition when positioned against the wider backdrop of global market uncertainty. 2023 was a difficult year for both managers and investors, but despite that prevailing complex geopolitical and economic picture, Jersey saw a number of significant fund launches and we have a robust pipeline of new funds and managers.

“It remains vital, however, that we stay cognisant of what is an evolving environment whether that be from a regulatory, ESG, technological or geopolitical perspective in order to maintain our attractive ecosystem for alternative funds.”

That message was reinforced by Joel, who highlighted product innovation, including around the tokenisation of assets, as a key focus for the next 12 months. In particular, Joel, who is also head of the legal and technical sub-committee, pointed to the work the JFA was currently doing with the Jersey Financial Services Commission (JFSC) to modernise guidance for funds and special purpose vehicles with exposure to virtual assets.

He added:

“It has been another busy year for the legal and technical committee with sizeable collective efforts being undertaken regarding our AML/CFT framework, guidance around virtual assets, a response to what has been coined the ‘retailisation’ of alternatives, and improvements to our successful JPF regime. The coming months are set to be no quieter, but we are fortunate to have a collegiate approach that will ensure Jersey remains competitive based on what it has become known for - cost, speed to market and quality - all underpinned by an innovative mindset.”

At the event, the JFA’s annual dinner was also confirmed to take place on 28 June this year. Further information can be found via the JFA website.

JFA Chair Michael Johnson provides an analysis of the evolution and current state of Jersey's funds sector for the 2023 edition of annual coffee table publication First for Finance...

By Michael Johnson, Chair, Jersey Funds Association

As the global disruption of a pandemic continues to fade in the rear view mirror, new challenges – and opportunities - have come to the fore for Jersey’s funds industry.

Regulatory, economic and geopolitical change are now staples of the environment we operate in, but the good news is that Jersey's funds industry has been able to adapt to such a fast-evolving environment.

Jersey's forward-looking approach, commitment to first class service and focus on creating an ideal ecosystem for alternative investments have enabled its funds sector to thrive over recent years – but increasingly it is the jurisdiction’s ability to be agile and innovate in the face of change that is shaping our future course.

Buoyant

The past year has been another successful and buoyant one for our funds industry.

Figures in early 2023 indicate that the total net asset value of funds under administration in Jersey stood at a record high of more than half a trillion pounds (£523bn), with Jersey private funds continuing to increase year-on-year.

In addition, we are seeing an ever-increasing community of managers fully resident in the island across private equity, hedge fund, venture capital, debt and real estate. These managers provide depth and diversity to Jersey's industry, at a time when substance remains high on the agenda.

Jersey’s expanding and enhanced product range is being warmly received by global managers and investors too.

The Jersey Private Fund regime (JPF) continues to assert its appeal as a fast, cost effective fund vehicle which is ideally suited to a small number of sophisticated institutional investors. More than 600 JPFs have now been established in total – meaning that their number has now overtaken Collective Investment Funds (CIFs) in Jersey for the first time.

Amendments to Jersey’s Limited Partnership law and the long-awaited introduction of the Limited Liability Company (LLC) structure in early 2023 have also bolstered Jersey's options for overseas managers, particularly those in the US.

Jersey’s platform as a gateway to EU investor capital through private placement remains strong too.

With this year marking ten years since AIFMD was implemented across Europe, more than 400 funds and 200 non-EU managers are using the tried and tested National Private Placement Regime (NPPR) through Jersey to access Europe– a figure that has grown by around 60% in five years.

It’s clear that global managers continue to respond positively to Jersey’s private placement option, which holds particular appeal for those who do not require a full onshore EU presence – which is around 97% of managers, according to the EU’s own figures.

As investors continue to navigate a challenging landscape, Jersey’s funds sector is, overall, in a good place, with global trends supporting the future outlook of our industry as investors continue to focus on the opportunities presented through alternatives– private equity, venture capital and real assets - areas where Jersey has particular expertise and experience.

Challenge

It is, however, prudent that Jersey remains on the front foot, alert to changes in the landscape and ready to respond with agility to market shifts.

At a macro level, for instance, Jersey’s weighting towards alternatives could turn out to be our greatest challenge should the industry adopt a cautious outlook as we cross the rubicon to a higher interest rate environment.

In early 2023, for instance, two-year UK Gilts stood at 5.5% and are expected to surpass 6% in the next year. That’s the benchmark for the risk-free rate – the key hurdle for allocators when determining allocations to portfolios.

Not only that but allocators are also contending with the denominator effect, further impeding their sentiment and ability to continue to allocate so freely to closed-ended alternatives. We cannot ignore some significant sectors that are likely to be impacted – real estate, a key area for Jersey, being one.

In this new era, embracing innovation, being agile and looking at our product range to see how we can introduce a wider choice of products and services will be vital. It’s why this year the JFA has established an innovation sub-committee to look at a range of ideas – such as developing the foundations for holding assets using digital ledgers.

The tokenisation of real assets looks set to have a transformational impact on the cross-border funds industry in the coming years. We are already well engaged on that topic, but it is vital we maintain momentum in an area that is witnessing real acceleration.

We are also well positioned in the rapidly growing arena of ESG investing. Jersey has a clear sustainable finance vision and is making good headway in implementing on that strategy – but as international regulation evolves, it’s vital we keep up with the pace of change.

The MONEYVAL assessment in 2023, meanwhile, has also underlined the importance of asserting our industry’s strength in combatting financial crime and working collectively as an industry and with the government to ensure our national approach is fully aligned with our industry approach.

Jersey's reputational advantage has long been at the heart of our success and as an industry we continue to be alive to the importance of being able to demonstrate the highest standards of anti-money laundering, compliance and governance.

In addition, if we are to maintain our growth trajectory, we need to be able to draw on a sustainable workforce. Experience and expertise have long been Jersey’s hallmarks, and a commitment to sourcing the best talent to boost productivity – in tandem with digital adoption - will be critical in the years ahead.

With that in mind, the JFA remains proactive in attracting both young and diverse talent to the industry and enabling ‘career switchers’ an opportunity to enter the sector.

As we look forward, the ability of our industry to be agile and embrace innovation, balanced against a commitment to remaining a stable and certain domicile, will continue to be at the core of Jersey’s proposition. If we can achieve that balance, then our funds industry can approach the future with confidence.

You can read the full Jersey: First for Finance publication as an e-reader here.

Speakers at the latest JFA Masterclass event explored the evolving regulatory landscape Jersey's funds industry operates in...

New regulation, both domestic and international, is creating significant opportunities for Jersey’s funds sector – but at the same time is requiring industry participants to be more agile than ever before, according to speakers at a recently held Masterclass event organised by the Jersey Funds Association (JFA).

Expert speakers at the recent event, held in September at the Royal Yacht Hotel and attended by over 50 industry representatives from Jersey's funds sector as well as colleagues from the Government of Jersey and the Jersey Financial Services Commission (JFSC), provided valuable insights into the evolving regulatory environment and the impact on Jersey’s funds sector.

In particular, the event emphasised the significant ongoing regulatory changes in both the UK and EU, including the UK’s ongoing efforts to enhance its ecosystem for asset managers and the EU’s review of the AIFMD. Prem Mohan, Partner at Kirkland and Ellis, highlighted how evolutions to AIFMD II could bring greater compliance challenges, whilst also pointing to how National Private Placement (NPP) arrangements, such as those through Jersey, still provide a good route to EU capital for non-EU managers with the current expectation that the NPP regime will remain in place for the mid-term.

Helen De La Cour, Director of Financial Services for he Government of Jersey highlighted Jersey's focus on developing regulation to ensure inclusive and appropriate access to financial services while being committed to enabling the funds sector to continue to grow and innovate.

David Eacott, Executive Director of Supervision at the Jersey Financial Services Commission (JFSC) shared his observations on Jersey's funds sector from his first half-year in post leading the JFSC's supervisory activities. David pointed to tokenisation and digital assets being very much on the JFSC's agenda.

Closing the session, David Postlethwaite, Sustainability and ESG Lead at KPMG, explored how ESG regulation was being integrated across the funds sector and how managers were having to increasingly apply an ESG lens to their due diligence procedures – something that is driving greater data sophistication when it comes to reporting and disclosure.

Jon Stevens, Chair of the JFA’s Regulatory and Compliance Sub-Committee and Deputy Managing Director of Mourant Consulting, hosted the event. He commented:

"Our latest Masterclass offered our broad funds sector a valuable opportunity to delve into crucial areas of regulatory progress. It’s clear that regulation in multiple areas – from sustainable finance and digital assets to domestic compliance and shifting international standards– are all impacting our industry, and firms at all levels of the supply chain are having to be nimble in responding to those changes.

“At the same time, Jersey has an opportunity to playa role in the inter-operability of these regulatory changes – helping investors to navigate and make sense of what it all means, across borders. And that will be an invaluable role for Jersey's funds practitioners to play in the years to come. Against that backdrop, I’m really pleased that there was such strong interest in our latest Masterclass event.”

Further details about the JFA’s Masterclass series and other events can be found here.

Richard Anthony, JFA Committee Member and Head of Aztec’s Jersey Real Assets Team, explores the challenges currently shaping the UK real estate industry and how Jersey continues to actively facilitate high quality capital flows into the sector...

By Richard Anthony, JFA Committee Member and Head of Aztec’s Jersey Real Assets Team

UK real estate has long been an attractive sector for global investors – but for various reasons, it is currently not without its challenges.

It is also a sector where Jersey firms have considerable experience, with members of the Jersey Funds Association being fortunate enough to work with some of the top real estate fund and asset managers globally and specifically in the UK.

This piece provides a snapshot of the key issues currently facing the real estate sector, through the lens of our clients and investors.

The Rise of Inflation

UK inflation has continued to rise sharply in recent months, with 2022 seeing the highest rate reached in over 40 years. As central banks aim to control inflationary pressures, interest rates have also risen in dramatic fashion.

This has undoubtedly influenced investor sentiment towards UK investment, the ability to generate attractive returns on existing portfolios and to secure financing for new projects, not to mention the impact on valuations. Speaking of which…

Uncertainty Surrounding Valuations

Asset valuations in UK real estate have become increasingly uncertain and downward adjusted in various sub-sectors, particularly in the commercial real estate sector - with various factors contributing to this challenge.

As a result, deal flow has been impacted, with potential sellers not wishing to sell and potential buyers considering whether we are really at the floor of the market, keeping their capital dry or attempting a cheeky chip on price while at the heart of a transaction.

On the upside, various asset and fund managers are hopeful for a bounce in the final quarter of 2023 and moving into the start of 2024, with fingers crossed for the plateau and descent of interest rates, which will bolster market sentiment.

Ability to Raise and Retain Capital

Fund managers in the UK real estate sector face the ongoing challenge of raising capital for their funds.

With increasing competition and changing market dynamics, attracting investors and securing commitments can be a daunting task. Investors are becoming more discerning, seeking transparency, track records and granular level due diligence.

Additionally, many open or quasi open-ended funds are having to work hard to maintain liquidity, as certain investors look to re-allocate or withdraw capital from the sector.

In the current environment, fund managers must demonstrate their ability to deliver attractive risk-adjusted returns and navigate market uncertainties to gain the confidence of potential investors.

ESG Impact

In recent years, there has been a growing emphasis on environmental sustainability and energy efficiency in the real estate industry.

Buyers and sellers are increasingly considering Energy Performance Certificates (EPC) and BREEAM ratings when evaluating commercial buildings. This "flight to quality" trend means that buildings with higher ratings are more likely to attract buyers and command higher prices.

On the flip side, other buildings with lesser ratings are becoming harder to sell, forcing the need to either make further capital investment, or exit at less attractive valuations.

Jersey’s Role

Whilst the above challenges are undoubtedly shaping the UK real estate industry at present, and may persist for some time, members of the JFA continue to actively facilitate high quality capital flows into the sector through Jersey domiciled structures.

Why? The Island has a vast pool of industry leading legal and professional firms with talented real estate professionals. The legislation, regulation and taxation applicable to investment structuring is finely tuned, incredibly robust and sufficiently flexible to meet the needs of most investors.

If you are considering an investment in real estate through a fund or corporate structure, consider Jersey.

Expert speakers at a recent Masterclass event, organised by the Jersey Funds Association, provided valuable insights into key ESG developments and their implications for the local industry...

New regulation and industry wide adoption of ESG and sustainability metrics have created significant opportunities for service providers, while data management now occupies a central role in achieving ESG compliance, both in the eyes of regulators and investors.

Expert speakers at a recent Masterclass event, organised by the Jersey Funds Association, provided valuable insights into these dynamic developments and their implications for the local industry.

The event, held on 6th June at the Royal Yacht Hotel, attracted over 40 industry participants from Jersey's funds sector. The guest speakers explored various key topics, including the rapidly evolving regulatory landscape, Jersey's potential to grow as a leading centre for ESG funds, the integration of ESG principles in private equity, and the growing importance of data management in the ESG sphere.

The event emphasised the intricate nature of global ESG and sustainable investment regulation, noting the considerable differences in disclosure frameworks between Europe, the US and Asia. The differences present clear opportunities for Jersey domiciled service providers, managers and funds, who may opt in or out of differing jurisdictional frameworks, while relying on the robustness of the JFSC as their home regulator.

As global standards continue to evolve, especially in relation to nature and climate disclosures, the significance of "financial grade" data management is poised to grow. This, according to visiting speaker Antonello Argenziano, creates potential avenues for fund administrators and managers aiming to drive progress and differentiate themselves.

The speakers highlighted Jersey’s strong position, underscoring the alignment of its flexible ESG disclosure framework with international standards and that Jersey implemented anti-greenwashing rules in 2021, with further enhancements in the pipeline.

Tom Powell, Chair of the JFA's ESG Sub-Committee and CEO of Amthe Capital, led the first session on regulation and disclosure. Powell remarked: "Our latest Masterclass offered industry participants a valuable opportunity to delve into crucial areas of regulatory progress in the ESG investment landscape. The rapidly evolving lexicon of acronyms can be overwhelming. There is a genuine sense that Jersey's expertise in administration, data management, risk, compliance, and governance is highly desirable as the industry continues its forward momentum."

He continued: “It’s really important that as a jurisdiction Jersey continues to tell its story in this area, because it has a fantastic story to tell.”

The JFA thanks all those who attended and facilitated the event. More about Jersey’s proposition in sustainable finance can be found here.

The speakers at the masterclass were: Tom Powell, CEO of Amthe Capital - Jersey; Alison Cambray, ESG, Sustainability & NetZero Director at PwC Channel Islands; David Postlethwaite, ESG Associate Director at KPMG in Jersey; Antonello Argenziano, Product Director at Intertrust Luxembourg; and Jane Burns, Sustainability and Climate Change Engagement Manager for the Government of Jersey.